If you are a United States citizen, the Child and Dependent Care Credit may make those summer camp expenses more manageable. Tax credits are more advantageous than deductions since credits reduce your taxes dollar for dollar.

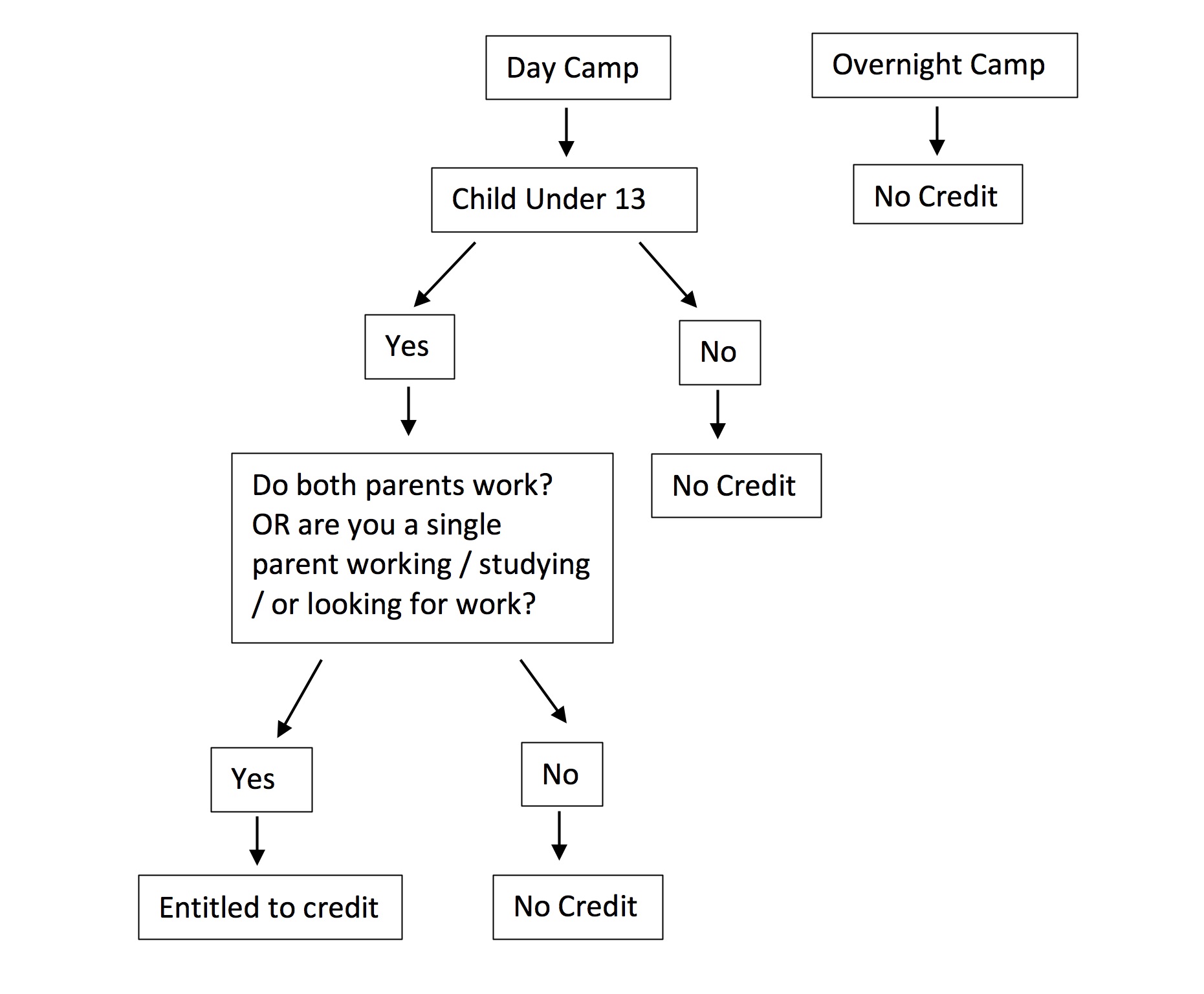

The Tax Man distinguishes between the two types of camps: Day Camps (like Arte al Sole) and Overnight (Residential) programs.

Check out the graphic below to determine whether you can take a tax credit for your child’s camp enrollments.

If your answers come to YES, then what are you entitled to? You are entitled to the amount you pay the camp (no gas, transportation, etc. unless it’s included in camp fee) up to 35% of camp costs to a maximum of $3000 for one child. This calculates to a maximum credit of $1050. If you have two or more children in camps, the maximum will double, up to $6000 for a credit of $2100 toward your income taxes.

ARTE AL SOLE DAY CAMPStake place June / July 2019 in cities and countryside across Italy, from Soccer al Sole in Umbria, to uncovering myths & legends and more! Ask about private programs for family reunions, private art tours & workshops, and a Rome spring program too! For more information or to sign up: https://www.artealsole.com/summer-2019-camps-in-italy or drop us a line! info@artealsole.com